Founded in 2015, Fast Radius went public through a SPAC on February 7, 2022 trading as FSRD on the Nasdaq. Just nine months later it declared bankruptcy. What happened?

This is my attempt to tell the story from my perspective and untangle a bit of the mess. This isn’t a particularly interesting case study but I happened to be there so there you go.

The Beginning

On a sunny day in December 2019 I was skiing at Palisades Tahoe with a friend when I checked my email on the chairlift. In my inbox was a subject that made my day: “Welcome to Fast Radius!”.

The letter outlined my salary, annual bonus, and – new to me – 7,500 stock options. I previously worked at established companies that didn’t offer stock options but I understood the idea. At employee 50 I could be like the early Amazon or Microsoft employee who got rich because they owned a sliver of the company.

On the other hand, I knew most startups failed – and only two became Microsoft or Amazon – so the most likely value of my options was nothing. The cash compensation was enough for me so I didn’t negotiate for more stock options.

I recently read “Barbarians at the Gate” and it has spurred an interest in finance and motivated a look back at my time and a closer look at the SEC filings. The characters and writing here aren’t nearly as good.

Fast Radius

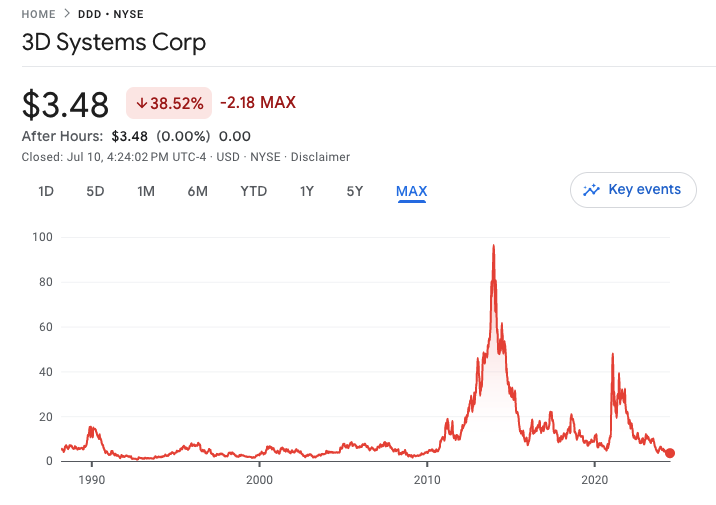

After a previous hype cycle in 2013-2014, 3D printing was back in headlines in 2019 and interest was brewing with pundits saying it would revolutionize manufacturing.

An article from Built in Chicago on Apr. 02, 2019 sets the scene:

Fast Radius Raises $48M, With Plans to Double Its Team

Once the domain of hobbyists and designers, 3D printing has entered the big leagues, and investors are taking notice.

Fast Radius, a Chicago-based digital manufacturing company, announced on Tuesday that it has raised a $48 million Series B round.

Chief Operating Officer Pat McCusker said Fast Radius will use the funding to bolster its software development and physical engineering efforts, build new manufacturing sites and grow its sales team.

“We have about 45 full-time employees, and we expect to double that in the next year or so,” said McCusker. “Most of that growth will happen in Chicago, and we’re really excited about that.”

Founded in 2015, Fast Radius builds industrial-grade components — think airplane parts, medical equipment and custom car parts — using additive manufacturing, or 3D printing.

I was hired as part of that headcount growth. Nice!

Growth

Despite the COVID-19 pandemic, 2020 and 2021 were exciting. Growth is exciting. As software people we didn't want to go into the office anyway, so it wasn't too bad to work remotely.

It wasn’t WeWork lavish but the company was spending money: hiring, new office space in the Loop, new factory space on Goose Island (a former Infiniti dealership), new CNC machines. As a data scientist, I was pushed into management to grow the team – so now became “Mr. Manager” (it’s just manager).

On Jan. 24, 2022 the company opened an office in a fancy banking space in downtown Chicago at 33 N. Lasalle St. where visitors “must wear a mask at all times unless actively eating/drinking”. Like our time in the Nasdaq – it didn’t last long – and I only visited the office once or twice.

SPAC

On July 19, 2021 our CEO Lou Rassey sent out an email concurrent with a public press release:

Exciting news for our company

I’m writing to share some exciting news about our company. Earlier today, we announced that Fast Radius will become a publicly-listed company through a merger with ECP Environmental Growth Opportunities Corp. (ECP), a publicly traded special purpose acquisition vehicle (SPAC).

Best, Lou

It sounded amazing with eye-popping numbers: a $1.4 billion valuation, $100 million private investment, $345 million from the trust fund account. Amidst all these numbers the $35 million in transaction expenses seemed reasonable. Plus, my stock options suddenly became more concrete.

Fast-forward to February 4, 2022:

First, today is an exciting day as we successfully completed our business combination with ENNV! This means that our first day of public trading will be Monday, February 7th, and we will officially be listed on the Nasdaq under the ticker symbol ‘FSRD.’ On Wednesday, February 16th, we will ring the closing bell on Nasdaq in New York City.

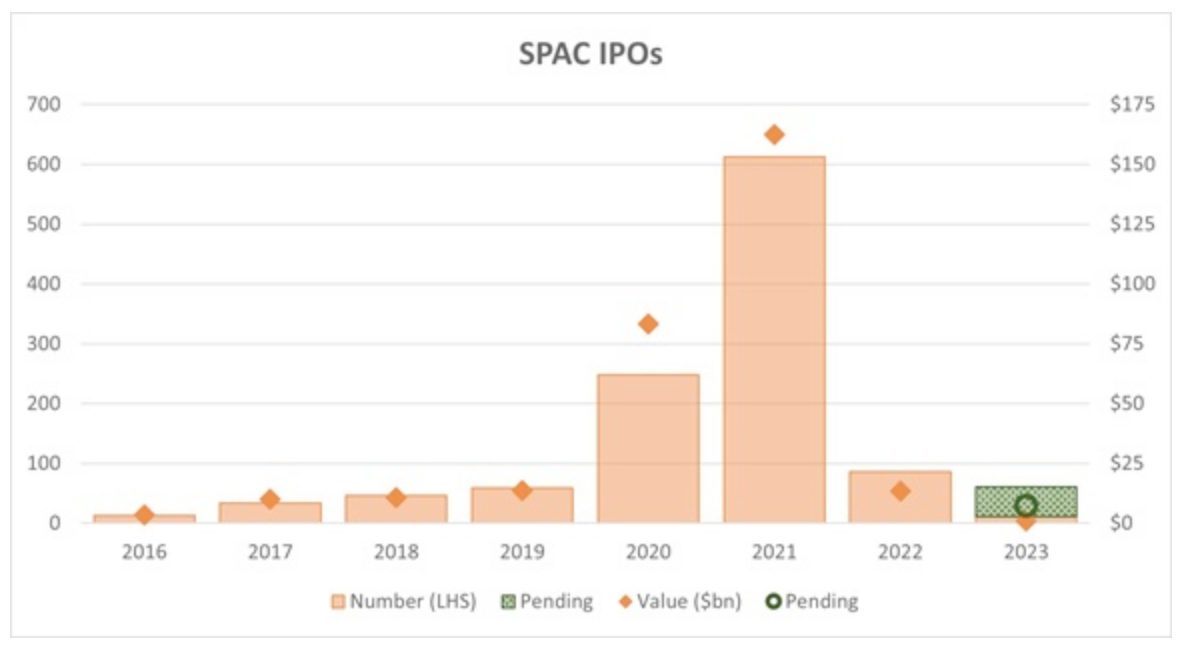

Third, I want to quickly reflect on the outcomes of our SPAC process. As we’ve discussed, we are in a turbulent market, the SPAC process has drawn some scrutiny, and as a result, many SPACs have experienced high redemption rates. We were not immune to this trend—we saw high redemptions from ENNV shareholders.

Onward, Lou

The redemption rate certainly was 91% so the capital from the trust fund was $29.6 million instead of the hoped-for $345 million. The PIPE was $75 million instead of $100 million (someone dropped out). Transaction fees eclipsed the trust fund account.

Fast Radius in 2022 was part of the cohort that killed SPACs.

Failure

The stock price started at $10 and dropped quickly. By the time my six-month lockout period ended the stock price was below my option price.

The end was announced on Nov 7, 2022:

Corporate update

Team,

This evening, we announced that Fast Radius filed for protection under Chapter 11 of the U.S. Bankruptcy Code. Now that we have filed, we are working closely with our partners to facilitate a capitalization or potential sale of our business.

...

Albeit in a challenging and unfamiliar time, I ask each of you to continue to be mindful of our shared purpose to Make New Things Possible everyday.

Onward,

Lou

Old habits die hard and Lou signed off with his usual “Onward”. The company was bought at the bankruptcy auction a week later for just $15.9 million and he was replaced as part of the deal.

Looking back, the decision to do a SPAC was the wrong one for Fast Radius. The company was late to 3D printing, late to SPAC, and late to regroup. Why was the deal done? As I learned in Barbarians, transaction fees power Wall Street – everyone wanted to get a deal done to get paid.

The holding company got its fee regardless of redemptions. Fast Radius leadership were awarded bonuses too: Lou got $2.4 million for closing the deal.

Conclusion

The FSRD ticker is gone, you won’t find it on Google Finance, Energy Capital Partners has scrubbed all references to Fast Radius and we all move on. You kind of wonder at the end of the day what the point was. Fast Radius was public for nine months.

If you go back to the old Steve Martin quote, “Be so good they can’t ignore you.” The converse is also true, so I suppose it’s fitting that Fast Radius is forgotten and ignored. Goldman Sachs and Palantir losses paid my salary though so that’s not too bad.

Despite an IPO, my naive assumption that most startups fail and the options wouldn't be worth anything turned out to be correct. Now that I’m wrapping this all up you may be wondering when I'm going to answer the original question, “Why did Fast Radius fail?”. That's getting punted: part two will dive into the details and financial documents.

References and Links

Fast Radius Announces Completion of Merger with ECP Environmental Growth Opportunities Corp.

Despite Slowdown in SPAC Activity, Opportunities Remain | Insights

Bar chart of SPAC IPOs The State of the SPAC Market - Russell Investments - Commentaries - Advisor Perspectives

A quick recap outlining how Fast Radius failed so quickly:

Dashed Dreams: What Happened to Fast Radius? - Engineering.com

SyBridge Technologies to Acquire Certain Assets of Fast Radius

Digital Manufacturing Company Fast Radius Goes Public with $1.4B SPAC Agreement - 3DPrint.com